Tampa Bay Business and Wealth’s Tech Connect series is designed to bring together individuals that hold strategic leadership positions in the areas of technology and innovation, in the Tampa Bay area.

These events provide an outlet for IT leaders to collaborate, discuss issues, exchange ideas and share insights, with an invitation-only audience.

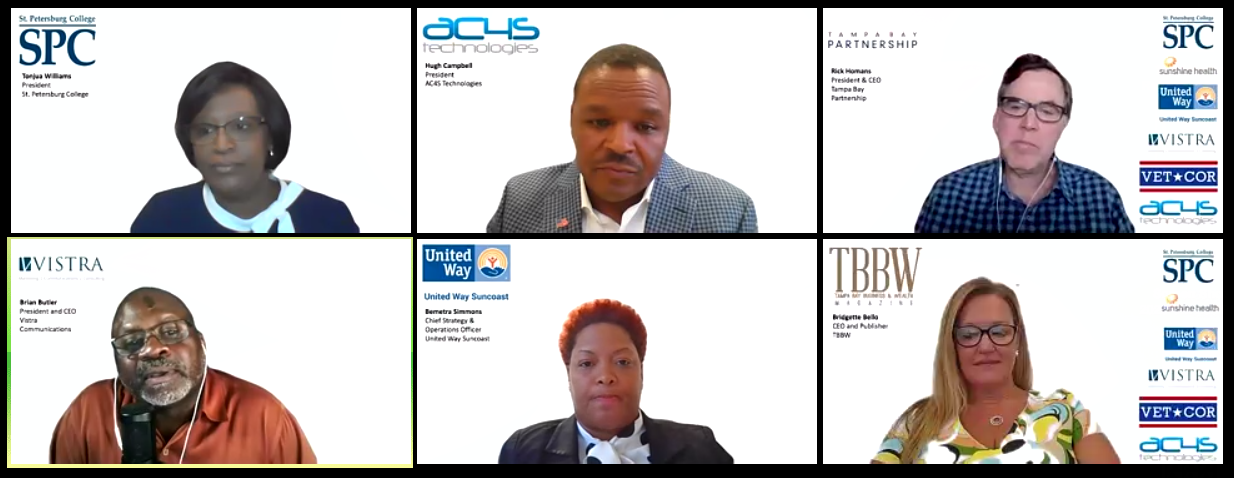

The discussion was moderated by TBBW publisher and CEO Bridgette Bello and held via Zoom.

Presenting sponsors were Acuity, Source1 Solutions, Three Bridge and Ecover. Gold sponsors were PSCU and Spirion

The Panelists

• Shilen Patel, CEO and founder, HealthAxis Group.

• Andrew Wall, president and chief operating officer, HealthMap Solutions.

• Ben Sever, CEO, Ecover Global.

• Jane Mason, founder and CEO, Clarifire.

Ben, how do you foresee this new remote world affecting the traditional face-to-face business model?

Sever: We’re a 100 percent SAAS-based company, and what we’ve seen is that people that are making decisions now on Zoom calls or Zoom board meetings, really have to be cross-functional. People think of social distancing as moving away from being social but the new remote workforce is forcing people to become more sociable.

It’s something I’ve pushed my department heads to look at. Right now, we want to run very lean as do many other companies, to avoid layoffs. I’ve seen a shift to what I would call operational engineering, someone who is crossfunctional but also very communicative, too.

People that are very engaging, and energetic, and have a good understanding of about the business are the people that are going to thrive in this new normal.

Shilen, what do you anticipate will be the needs to bridge the gap for human connection outside of video conferencing applications?

Patel: I’m getting more intense human contact now than ever before. We have small kids at home and I realize that a part of my superpowers was disappearing for eight or ten hours a day.

We’re having a lot of human connection at my house, so that void has been filled a little bit.

Joking aside, I think that psychologically and biologically, I feel that humans are just wired [for social connection] and so much of what we do revolves around presence, contact and community.

Zoom and other platforms can do a job, but I think that that in-person connection is more vital. And to me, it has been underscored by this whole experience. I would use the analogy of back when we all used to travel, sometimes you’d stay at an older hotel and you’d be there for a week and they would have a 30-inch regular definition TV and the first day, it’s weird and then by day two, or three, you’ve adjusted to it. And then you go home and you see your HDTV and you’re like, “Oh, my God!”

I think that we’ve found great utility in these tools but in-person connection, when it all comes back to us and we have the opportunity to do those things again, I think that the difference is going to be very clear.

Jane, I have a question for you. What changes are you seeing in the financial services industry that impacts everyone and the way that business is done?

Mason: One of the things I wanted to share today about the financial services arena, which touches all of us. I think what we’re going to be seeing is your banks, and local credit unions, are all talking about how you can self-serve. So there’s going to be less human touch. To your points, Ben and Shilen, you said everybody loves the human touch but there are some things you don’t want to touch. For example, if you lost your job and you needed a forbearance, you didn’t need to talk to anybody about it, you just wanted to click that button and get that approval.

I think this pandemic has opened an opportunity for us to be more personal with everybody we’re talking to. There are other things we can talk about now instead of just the weather, that I think is personal. Like, how’s it going with that new puppy? Which I have. I think there’s an advantage of the situation that we’re all in.

I think that automation is going to be important for everybody because some of us don’t want to talk to people all the time, we just want a system responsive to us, but to get together in person is critically important when we want it. So it’s really about that on-demand, personal access that I think is evolving more and more every day.

Andrew, what is the future of medicine and telemedicine? Is the CMS waiver here to stay? Is payment parity and interstate licensing going to continue gaining traction, post-COVID?

Wall: When we launched Healthmap, back in 2007, one of the goals then, and still today, was how do you best leverage technology to drive better health outcomes for patients. And we specifically focus on folks that are very vulnerable, and sick, with chronic conditions. If you think about telehealth or telemedicine, different terms for how you exchange different types of information, including medical data, through some type of electronic means to improve a patient’s health. It isn’t a new concept but it’s traditionally been underutilized, whether it’s technical barriers or regulatory issues or lack of incentives for doctors to embrace it, COVID has changed all of that.

Specifically, as it relates to the waiver of CMS or the Centers for Medicare Medicaid Services, the federal agency that administers the Medicare program, due to COVID, CMS modified some of their rules to allow payment for some telehealth services so that those patients on Medicare could receive a wider range of services from their doctors without having to leave their house and travel to a health care facility.

This, from my perspective, is a great example of where telehealth is being used effectively, where you don’t want to have in-person contact but you do have folks that still need routine health care. It’s a great way to keep those vulnerable patients, or those with mild symptoms, in the safety of their homes while maintaining access to vital care that they need. I think we all agree that keeping more people at home is a great way to limit the spread of the virus.

The payment rules are a big deal, so CMS easing those rules for reimbursement allow those doctors to treat more patients in the safety of their own homes. We see telehealth expanding in the future and there’s no doubt that COVID accelerated that.

As we move forward, I think you will see CMS set the tone for Medicare, as well as other insurers.

Trying to strike that balance between encouraging access to telehealth but also managing what we hear, which is a provider’s concern, that telehealth could be used to replace, rather than supplemen,t in-person health care delivery.

Routine check-ins make a lot of sense. The doctors we work with really embrace telehealth for those reasons. We definitely will see an uptick, as we move forward. Things like remote patient monitoring or patient education, those things make a lot of sense and we’ve seen payment policies and rules relaxed.

For example, there’s some patient education that doctors like to do for folks with kidney disease, and diabetes, and other chronic conditions and in the pre-COVID world, you had to go to the office to get that education for that doctor to get reimbursed.

We think a lot of that will change as we move forward.

Shilen, I didn’t know if you wanted to weigh in on that specific question. Can you start with explaining what CMS is?

Patel: CMS is the Centers for Medicare and Medicaid Services. So they set the policy for all of the government recipients of health care and where CMS goes, a lot of times the commercial and self-funded plans will follow. I’ve spent my whole career in health care IT, innovation in health care has never been a technology problem. The technology has always been way ahead of, what’s done.

The challenge is rules, risk management, risk aversion and a risk-averse mentality that exists in health care. Telemedicine has been around. We use this technology for a lot of other things in our lives. Remote connection, sharing of data, all of that type of stuff. But the rules have always discouraged it. First, it was if you’re a doctor in Florida, you can only take telehealth visits in Florida. You’re not licensed for somebody in New York or Wisconsin to call and do the visit.

Now, they’ve broken those rules down and it’s in 50 states. But they also changed the reimbursement. In a fee-for-service world, which is, I fix what’s wrong with you and I get paid for that, versus a value-based-care world which is I get compensated, and rewarded, for preventing something bad happening to you.

That fee-for-service world always incentivized going into the office because that paid more. I think this accelerated something that needed to happen all along. The CMS administrator came out in a meeting last week saying that she would like to make the waiver permanent. And I think it’s what makes sense.

When you think about your family doctor, and primary care, everyone can visualize that. As you get into specialties, it serves some better than others. It’s not, universally, helpful. I feel like we’re taking a big step forward. I think once that doors open, it’s going to be hard to walk back. I think the doctor’s incentives are there to make sure that they continue to embrace the model because it wasn’t before.

Sever: That’s one of the biggest things. For those of you that don’t know, eCover came to market right before COVID hit. We were pretty much just targeting enterprise patient engagement, just doctor to provider, something with the CMS laws, in specific the interoperability act, removed information blocking for people who are SAAS-based, we consider ourselves a SAAS-based suite of software, we can use EHR integrators to plug into different specialties and plug into both providers, and patients, and host all of that information in our mobile suite of software. From not only an actual patient accessibility standpoint, from being able to go into a doctor’s office and talk to a doctor and then be able to see other pieces of critical information, also from a health-tech standpoint, we can provide better software now and more robust software predicated off these rules that have changed.

From both sides, both patient care and mobile accessibility it’s pushing forward all that needed to change for the betterment of everyone.

Building trust via Zoom is not an easy thing to do, and for those of us that are still trying to build our businesses and make sure that our lights stay on and our employees stay employed, what’s the best way to start a relationship have it be a trust-based relationship and to move forward in that sales process?

Sever: We’re in a unique situation. We started 15 months ago and now we have over 30 employees. We’re able to scale, and be very agile, and build trust along the way, so it’s a lot easier to do it with a new, young startup, so our strategies might not be universally applicable. Something that I did, as a leader of our organization, was full transparency from the start, from our interns up to myself, the chairman of the board, we have full open door, and open Zoom policies.

In the past quarter we’ve grown 200 percent, both funding and staffing wise. We’ve had to add an internship program, we had to add associates, we added some board members and some investors, so what we have done, literally, had to add an open-Zoom policy.

We’ve had every single person, has been listening in to investor calls and listening to what, specifically, we’re spending the money on. We had someone, on day three, listen on a call while we discussed a capital raise. It shows an environment of what we’re alluding to now, which is psychological safety.

I want to go off something Jane said earlier, which was, people love seeing kids in the background and being open and goofy, it’s humanizing the culture.

Jane, part of the reason you came to mind for a cover in June was because your company was poised, and ready, for something like this to happen. You not only survived, you thrived and you guys grew like crazy. Everyone else on this call is in business, in one form or another, what recommendations do you have for them to work differently in this new normal, day-to-day?

Mason: From my perspective, we have an opportunity now, and a little more time, to be more introspective about our strategic goals. Our strategic goals have probably changed a little bit because we have to do the mobile access, we have to do the virtual meetings and we have to behave differently. So you also have to look at your products, and services, and how you’re selling them and what is making a difference to your customers. So you need to listen to your customers.

The key thing was how do you tell, with your data, that that particular person, customer or patient, has COVID, or has a family member who has COVID? None of the EMR, or EHR, or financial services back-office system, none of them have a provision to identify a COVID scenario.

So everybody is scrambling in both industries to try to automate, and get access to that data because they know everyone that is COVID-related has to be treated differently. Whether you’re getting a forbearance or a refi [-nance plan]. Even with telehealth, you have to get access to the data to make sure you’re understanding who you are treating and how you’re treating them, and if your back office system software doesn’t have the flexibility, and capability, of tagging that data, I think that it’s really important to think like that.

Everyone is working differently, we all know that, but what are you as a company doing to get in sync with that and coordinate your strategic initiatives?

Our company thought more about preparing for disasters, and preparing for what you don’t expect, and that’s where we targeted our process automation. So we were able to do hundreds of thousands of forbearance requests and now they’re all going to have to get loan modifications and referrals. There’s going to be some trouble if people aren’t thinking ahead.

We just put process automation in place that facilitates that and it’s the same thing with health care. They’re going to have a backlog of elective surgeries. They’re going to shut down and focus on COVID and they’re not going to do anything else but, then, where is their bread and butter? Their bread and butter comes from procedures that they do. So all of a sudden, you’ve got these large hospital organizations that have backlogs of elective surgeries that they canceled. How are you going to deal with that volume? In our world, we just prepared for automating it and making it as easy as possible.

Shilen, your company had a similar situation. Do you have anything to add to that?

Patel: In health care we probably looked around and saw the same thing, which was dinosaurs everywhere. When I started this company [Health Axis], what I knew is that I didn’t want to be a dinosaur, so we always had this principle on continuous learning, and innovation, and we kind of knew that even if we have the perfect strategy for a moment in time, the world changes and it’s not perfect anymore. So this idea of always asking, “What are the problems and what are the needs?” And then asking, once we’ve done something, “How did that go?” Whether it’s inside of our working teams or whether it’s with our customers. All of those things have come into play in this situation.

We have certain decisions we made on day 1 of going remote. We had 400 people ,in 8 buildings, and two days later we had 14 people in 8 buildings. We made a lot of decisions, in a short amount of time. We would be struggling if we hadn’t asked regularly, “How did that go?”

How are you leading your team during this time? What changes have you made and why?

Wall: We embraced the remote lifestyle. We’ve incorporated different things. Whether it be Zoom happy hours or Zoom trivia nights, we’ve tried to make sure that everyone feels included. It’s easy to feel detached from the company when you’re not altogether.

We’ve also hosted, and promoted, the idea of having done that with their family members. So my team has access and can use the technology for a remote conference or to have game nights with their families.

Inclusion is a big part of our culture and a big part of our philosophy and we’ve tried to embrace it. ♥