In this economic climate, financial literacy is a pivotal issue that can determine a person’s quality of life. The Florida Council on Economic Education, a nonprofit group on the front lines of the state’s educational system, is preparing young people for personal and financial success. It achieves this initiative through educational programs in economics, the free enterprise system and personal financial literacy.

Since 1975, FCEE’s mission has been clear. Each year, the organization helps empower thousands of teachers to nurture 400,000 Florida students to become productive members of the workforce, responsible consumers and wise investors. In fact, last year, FCEE provided educational resources, competition and awards for more than 80 percent of Florida’s school districts. The organization provides a standards-based curriculum, professional development training, classroom resources and advocacy for kindergarten-through-12th-grade educators around the state, free for users.

The FCEE motto is simple, yet powerful: “Train one, teach thousands.”

FCEE operates on what economists call “the multiplier effect,” a notion that inspires private donors, corporate sponsors and philanthropic foundations to support the five Centers for Economic and Financial Education based in Tallahassee, Jacksonville, Miami, Boca Raton and Tampa Bay.

The statistics from a fluctuating global economy reinforce the impact of FCEE’s educational programs. In a recent survey by the American Psychological Association, 80 percent of employees reported being affected by financial stress, 32 percent have zero non-retirement savings and 21 percent believe that winning the lottery is the most viable way to fund their retirement.

According to executive director Suzanne Costanza, “Young adults are entering the workforce poorly prepared for financial success in the global economy due to their lack of knowledge about credit, banking, insurance, loans and consumerism. Financially literate people have the skills to manage their finances, reduce the stress of debt and are less likely to face bouts of depression, anxiety, [use] payday loan services, create workplace distractions and, in some cases, resort to illegal means to temporarily resolve their issues.

“Financial literacy education isn’t just about debt management, and saving money, though—it includes creating informed citizens, teaching about consumer protections, fraud prevention, protecting and insuring, investing and, most importantly, decision-making.”

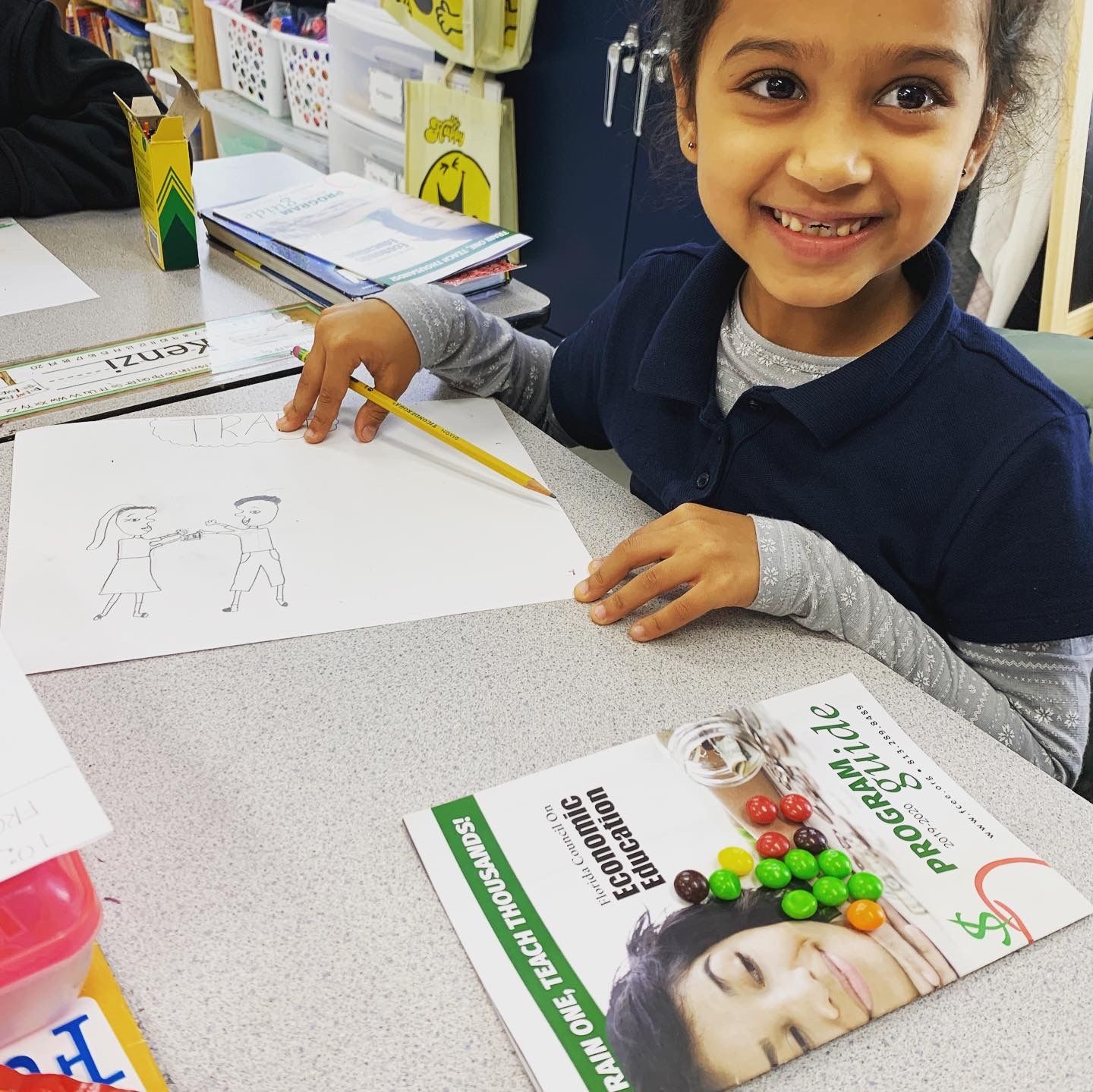

There are many ways to become involved in supporting financial literacy the community. The FCEE hosts the Regional Economic Educator and Leadership awards, which honor outstanding Florida teachers that excel in delivering lessons on personal finance and economic education. It is an example of financial literacy in action in classrooms day to day.

“The REEL awards are an opportunity to acknowledge the teachers that go a step above,” Costanza says. “FCEE is uniquely positioned to close the gap between knowledge and competence when it comes to financial acumen. The REEL takes a closer look at a teacher’s achievement, leadership and commitment—skills that are instrumental to make financial literacy come alive in the classroom.”

As shown by the graduates of the FCEE program, the multiplier effect is working. Each year, the Tampa Bay Times hosts the Tampa Bay Business Hall of Fame awards to recognize prominent business leaders in the region. In 2019, the Times highlighted Future Hall of Famer Award recipient, Dhruv Krishnan, a beneficiary of FCEE, as a young entrepreneur that showed that, “having a system that produces money for you, gives you the power to help the community.”

Local students such as Krishnan are already productive members of society, far ahead of peers that lack access to financial education, Costanza says, “To be young and full of hopes and dreams is one thing, but to be young and full of action, commitment and success is something else entirely.”

Krishnan presented this project, “A Machine Learning Approach to the Stock Market Using Random Forest Technique” to business leaders in the community. It was an innovative approach to the stock market that won him second place at the Hillsborough County Regional STEM Fair. Using a regression model, Krishnan was able to make more than 138 percent return, in one year. As a result, Krishnan has filed for three patents and looks ahead to a future in financial entrepreneurship.

“Once approved, I would like my patents to be used in ways that will help others,” Krishnan says. “My ultimate goal is to demystify the stock market and make it easily accessible, and understandable, for everyone. Charities, schools, universities, hospitals and even individuals could use my financial algorithms to invest their money and the net profit could then be used to fund their humanitarian efforts and other projects.”

As evidenced by the work of organizations such as FCEE, financial literacy that begins early in childhood sets up the habits for financially successful adults. By providing Florida educators with resources and tools, FCEE shapes the future generation of business leaders in the Tampa Bay region and beyond. ♦