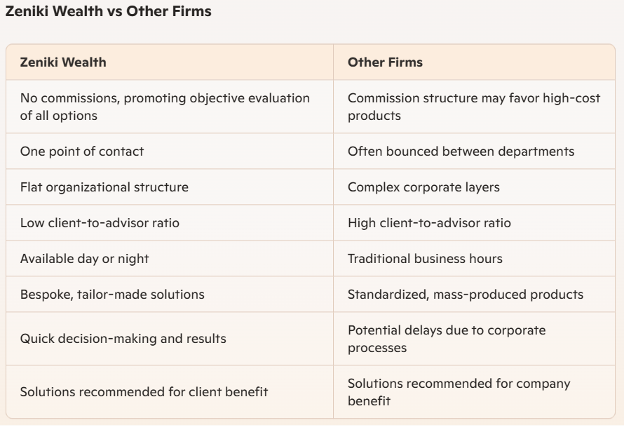

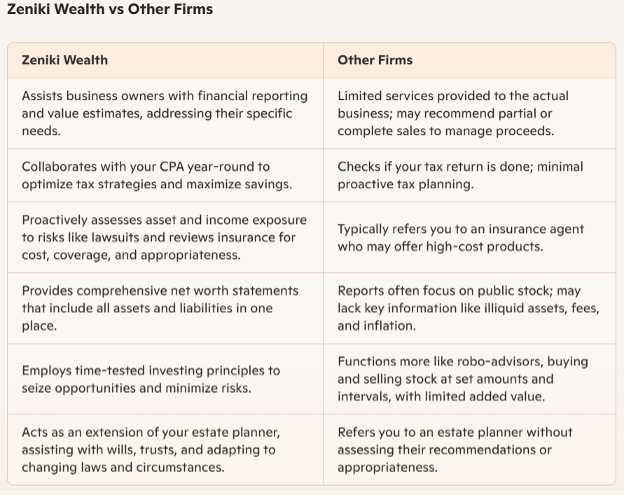

Clients with complex wealth often turn to large “Wall Street” firms or trust companies, but these organizations can sometimes present challenges. These firms may favor higher-cost investment products and standard solutions, which can lead to increased corporate profits. Additionally, there is a focus on acquiring new clients rather than providing exceptional service to existing ones.

At Zeniki, we do not work on commission, which means our recommendations are based solely on finding the best solutions at the most cost-effective prices. Our primary goal is to offer high-quality service tailored to your specific needs.

While most financial advisors are dedicated individuals, their compensation structures may sometimes incentivize a sales-oriented approach rather than providing entirely objective advice. Often, their expertise and capabilities are confined to the investment products offered by their employer, and any needs beyond this scope might be outsourced to third parties or left unaddressed.

At Zeniki, we operate without commission-based incentives and are not restricted by a single provider’s offerings. We have the freedom to source investments and financial solutions from around the world. This independence, combined with our commitment to high-quality service and financial expertise, ensures that you receive advice tailored specifically to your needs.

About Kyle Schlossman, CFA®, CPA, ABV, MBA

As the son of two teachers, Schlossman learned early on about the importance of hard work and education.

He attended the University of Florida and majored in accounting. After college, Kyle became fascinated with investments and spent significant time reading anything about the subject that he could get his hands on. This led Kyle to pursue the CFA® program, which is a rigorous, multi-year curriculum that focuses on investment analysis and ethics.

After obtaining the CFA® designation, Kyle resumed his self-study of investments, focusing his attention on successful investors like Warren Buffett (who he refers to as one of his role models). Kyle studied Warren extensively, reading dozens of books about him and even going out to Omaha, Nebraska to see him in person at his annual shareholder meetings. This experience laid the foundation for Kyle’s own investment philosophy and provided him with a framework for making rational investment decisions.

Kyle’s professional experience includes working as an analyst at Bank of America, where he specialized in managing illiquid investments and closely held businesses that were owned in trusts and estates. He then gravitated to the private client space and became the manager of a Tampa, FL based family office. While there, Kyle led the management and reporting of the family’s investments (which included real estate, private equity and marketable securities). He also assisted the principal with tax and estate planning and various legal and administrative matters.

Eventually, Kyle’s entrepreneurial itch became too strong to ignore. In 2023, he formed Zeniki Wealth so that he could provide comprehensive wealth management services to a greater number of clients and to address the many shortcomings that are inherent in the financial services industry.

Outside of work, Kyle enjoys reading, being active outdoors and cheering on his favorite sports teams (the Florida Gators and the Tampa Bay Buccaneers).