When was the last time your wealth manager, CPA, attorney and insurance agent all sat down—together—to talk about you?

If you’re like most successful business owners, the answer is probably: never, and independent research supports what you already know.

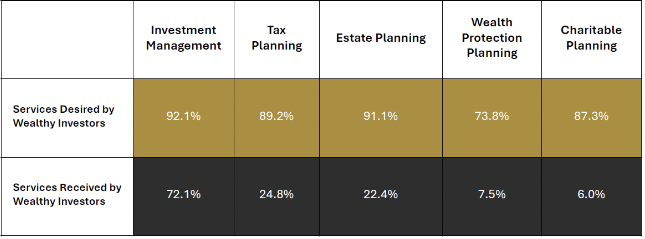

Nearly 90% of wealthy investors want tax planning services, but only about a quarter say they’re getting them. Over 90% are interested in estate planning, yet fewer than a quarter have received meaningful guidance. And while the majority say they want to be strategic in their charitable giving, only a sliver have had those conversations with an advisor.

So, you are not alone. The traditional wealth management model wasn’t designed for people like you—people with complex financial lives, significant business interests and big plans for their families and communities. The system is fragmented. The burden of coordination is on you. And even though many advisors say they offer advanced planning, charitable strategies or tax guidance, the reality is … most don’t.

You deserve better.

At a recent event, a leader in the Tampa Bay business community asked me what our firm, Questmont Virtual Family Office, actually does. It’s a fair question—and one that usually tempts a flood of technical jargon. But this time, I kept it simple:

“We deliver best-in-class experts across finance and lifestyle, coordinated through a single, consultative process built around you.”

He paused. Then said what we hear all too often: “Isn’t that what every financial advisor says they do?”

I answered: “Has your financial advisor ever coordinated with your CPA, attorney and insurance agent, and if so on a regular basis?”

His response: “Hell No!”

Most advisors offer investment management. That’s table stakes. But when it comes to advanced planning—things like estate strategies, wealth transfer or business succession—only a small fraction are actually doing the work, despite the vast majority saying they do. The gap widens even further with relationship management. Coordinating with other professionals, communicating across disciplines and proactively solving client problems isn’t just rare—it’s nearly nonexistent.

So no, it’s not what every advisor does. Not even close.

That’s where the Virtual Family Office model comes in. It’s a fresh approach built for the realities of today’s high-performing business owners and their families. It brings together experts in finance, tax, legal, risk and philanthropy—some in-house, others drawn from a national network—and coordinates them into one cohesive strategy. This isn’t about video calls. It’s about deep collaboration, extreme ownership and aligning every part of your financial life toward a singular goal: yours.

We sum it up with a simple formula: investment counseling, advanced planning and relationship management. But what it really means is that someone is finally looking at the big picture—and taking responsibility for every piece of it.

A client of ours, the founder of a medical device company, was preparing to exit her business. Our exit planning and valuation team uncovered untapped value in her financials, increasing her eventual sale price by 31%. Before the sale, we implemented a long/short investment strategy that generated capital losses to offset future gains, ultimately saving her over half a million dollars in taxes. Charitable strategies, layered with advanced tax planning, reduced her overall tax burden even further. And after the sale, we designed a custom rainy day fund portfolio that allowed for tax-efficient income throughout retirement, giving her peace of mind, flexibility and the ability to support the causes she cared about most.

That kind of outcome doesn’t happen by accident. It takes a coordinated, intentional structure—where everyone is on the same page, and everything is centered around the client.

Here’s what may surprise you: this level of service and integration doesn’t necessarily cost more than what most people already pay for piecemeal advice. The model is different, not the price tag.

At Questmont, we’ve built something intentionally rare. We’ve assembled a CPA and advanced tax strategist with nearly two decades of experience in valuation and business exits. We’ve partnered with the fifth largest captive insurance firm in the world. Our clients benefit from access to a $7 trillion trust company and the leading private insurance providers in the U.S. But what matters most is how these resources are woven together—with care, precision and a deep respect for what matters most to our clients.

Because at the end of the day, this isn’t just about money. It’s about legacy. It’s about time. It’s about impact.

And if the planning isn’t airtight, someone you love could end up paying the price.

You’ve worked too hard to settle for less.

You deserve better.

Contributed by Taylor K. Ranker, II, CEO and personal CFO, Questmont Virtual Family Office

Diagram note: N = 416 investors. 706 advisors | Copyright 2023, CEO Insights