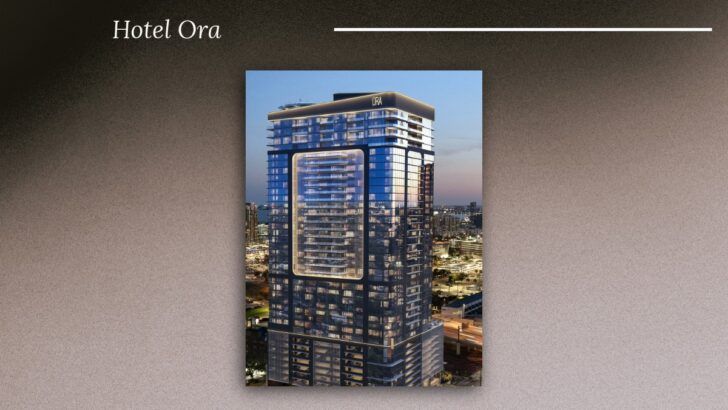

When Luigi Novembre talks about Hotel ORA, he does not start with finishes, amenities or even Tampa’s growth story.

He starts with leverage.

Novembre is co-founder and COO of ARC Realty Group, the firm behind the $675M condo-hotel project planned for downtown Tampa.

Once presales clear the equity requirement needed to secure a fully funded construction loan, Novembre said pricing on the remaining inventory would reset higher, by roughly 40% on the final 42 units.

“If I don’t get my price, I’ll hold the inventory,” Novembre said. “I don’t need to sell. I’m not sensitive to selling these units anymore.”

That posture is unusual in a market where many developers depend on sales velocity to manage risk.

It also reveals the underlying philosophy shaping Hotel ORA: control matters more than speed.

Financing first, sales second

Hotel ORA is being developed by ARC Realty Group in partnership with Prosper Group. The project sits just outside the Water Street district, one of Tampa’s highest-performing hospitality submarkets.

According to Novembre, location was not just a branding decision. It was a revenue strategy.

Room rates in this pocket of downtown are among the highest in the city. Occupancy remains strong even as hotels limit supply to protect pricing.

READ: TAMPA BAY BUSINESS NEWS

That combination allowed ORA’s pro forma to support construction financing without debt-heavy structures or aggressive sellouts.

Once financing was locked in, the project’s incentives flipped.

Selling slower became an advantage.

A condo-hotel model built around owners

Novembre has built several condo-hotel projects along the Pinellas beaches. ORA is his first in Tampa. The product looks familiar at a glance but the economics differ in key ways.

Traditional luxury condo-hotels often charge management fees between 50% and 55% of gross revenue.

ORA’s structure starts at 15% for the first two years, then rises to 20%. Homeowners association costs are also lower due to a vertical subdivision structure that removes major hotel operations from the HOA framework.

The goal, Novembre says, is to reduce fixed expenses so owners keep more of the upside.

READ: TAMPA BAY REAL ESTATE NEWS

“I make it owner-centric,” he said. “We make money together.”

That alignment is central to the philosophy.

Buyers choose units first. The developer retains the remaining inventory as equity rather than cashing out early.

“You pick first,” Novembre said. “I keep the rest of it.”

Returns are tied to long-term operating performance rather than a fast exit.

It is a slower model. It is also less flexible if market conditions shift.

The submarket advantage

Hotel ORA’s strategy depends heavily on its location.

Novembre argues that downtown Tampa’s core operates differently from other Florida condo-hotel markets, such as Miami or Fort Lauderdale, where thousands of similar units compete for the same guests.

In Tampa, supply remains limited.

“Location, location, location,” Novembre said.

Recent data shared with city officials shows a growing gap between available rooms and demand in this submarket.

Higher average daily rates combined with disciplined occupancy caps have pushed some visitors out of the area altogether.

READ: DOWNTOWN TAMPA DEVELOPMENT & REAL ESTATE NEWS

Novembre points to how luxury hotels manage that trade-off, noting that properties can make more money by protecting rates rather than chasing full occupancy.

“You make way more money by not going over 78% occupancy,” he said.

That imbalance supports pricing. It also creates risk if new supply arrives faster than demand can absorb it.

For now, ORA is betting the window remains open. Novembre said the model does not travel well across a city’s map.

“If you step outside of my submarket, those room rates are going to come crashing down on you,” he said.

Amenities as revenue engines, not just perks

Much of ORA’s design has already been covered: rooftop pool, spa, fitness center, convention space and a helipad planned with future autonomous air taxi use in mind.

What is less obvious is how these elements are meant to feed the operating model.

The second-floor event and convention space is designed not only for private functions but ticketed performances.

Novembre says comedy shows, live music and branded events could help drive room demand during slower periods.

The helipad is positioned as another lever. Autonomous helicopter service between Tampa International Airport and downtown is expected to begin later this decade.

READ: Channelside Development & Real Estate News

If it materializes, ORA would be positioned to capture travelers willing to pay for speed and privacy.

These features are not without cost. Staffing, security and maintenance will add complexity. Success depends on execution as much as concept.

Novembre said he has leaned on outside hospitality expertise to reduce that risk.

“I don’t know how to build a hotel,” he said. “I want to hire the best.”

Who is buying and why it matters

ORA’s buyers tend to be physicians, executives and business owners with investable assets starting around $3M. Novembre says the average net worth is closer to $15M.

That profile matters.

High-net-worth buyers are less likely to panic sell during downturns.

They are also less likely to provide liquidity if conditions change. Units held tightly can protect pricing but may limit flexibility if demand softens.

It is a tradeoff embedded in the philosophy.

Discipline cuts both ways

Novembre describes himself as a numbers-first developer.

He spent years in financial services before entering real estate. Every project, he says, must make sense on paper before it breaks ground.

That discipline has helped his previous developments finish on or ahead of schedule. Hotel ORA is projected to take roughly 35 months to complete.

Still, pricing power depends on timing. Holding inventory assumes continued demand at higher price points.

READ: TAMPA BAY TOP COMPANIES

If interest rates shift again or luxury travel slows, leverage can narrow quickly.

The strategy works best when conditions cooperate.

Novembre also said he is careful about how the project is marketed and modeled because condo-hotel deals can drift into regulatory gray areas if developers oversell returns.

“As a developer, if you give pro forma information, you end up going to jail because you’re selling a security,” he said. He said he relies on third-party expertise and property valuation work rather than pitching financial outcomes himself.

A test case for downtown Tampa

Hotel ORA is not just another luxury tower.

It is a live test of whether a slower, owner-aligned condo-hotel philosophy can hold in a growing but still maturing market.

The project does not hinge on selling out. It hinges on maintaining discipline.

The question is not whether ORA can be built. Financing is already in place.

The question is whether pricing power can outlast the cycle it depends on.

For Tampa’s business and real estate community, that answer will say as much about the city’s evolution as it does about one developer’s philosophy.