Recent data from Newsweek paints a troubling picture of retirement in America: Two in five retired Americans...

Dr. David Phelps

Dr. David Phelps created Freedom Founders to help its members achieve the freedom they wanted in their lives by building the necessary financial foundation.

While he was entrepreneurial as a kid, he still followed his father’s path into the dental field, but when his daughter developed serious health issues, it made him realize he wanted more time to spend with her than his dental practice would allow. So he evaluated the revenue produced by his real estate investments and realized that could sell the practice and live off of his real estate—allowing him to spend more time with his daughter. Once he did that, other dentists started asking him what he was doing and how he was supporting himself after selling his practice, which led to many of them co-investing with him on new deals.

This was the inception of Freedom Founders, and it’s been helping other people achieve the freedom they wanted ever since.

Investor sentiment—not fundamentals—is what drives financial markets today. If you need evidence, just look at the past...

The April jobs report was just released, and on the surface, it looks like good news. Nonfarm...

3 Things You Need to Know About Business Funding in 2025 As we head into 2025 with...

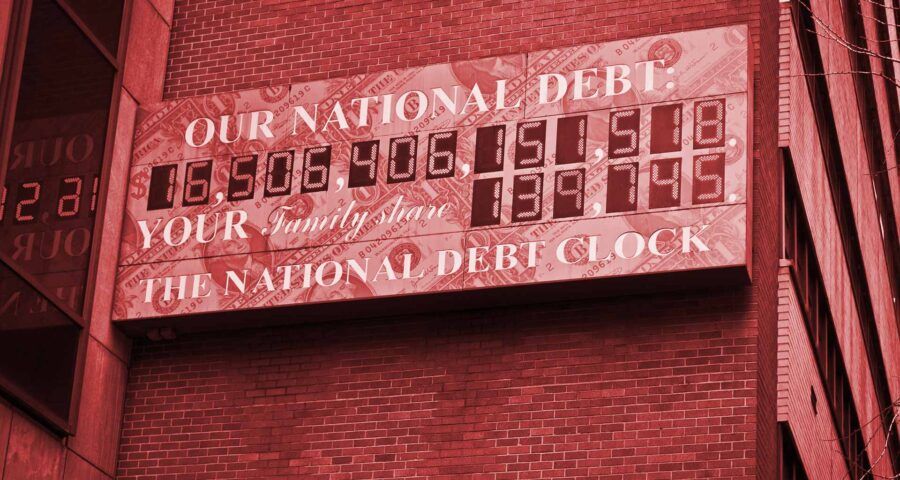

The U.S. national debt is rising by $1 trillion roughly every 100 days right now, which now...

I vividly remember being a teenager, and some of the things I believed back then, frankly, many...

You probably remember hearing all about the Titanic in great detail during history class. You might remember...

Despite most TV pundits loudly proclaiming over the last few years that the US economy is strong,...