The April jobs report was just released, and on the surface, it looks like good news. Nonfarm...

Banking & Financial

The latest plunge in stock market performance, largely attributed to the Trump administration’s new tariffs and an...

3 Things You Need to Know About Business Funding in 2025 As we head into 2025 with...

Last night, while speaking about getting funding to a group of entrepreneurs at a mastermind event, a...

Many Americans today are worried about their financial future. This isn’t a surprise to most of us...

Real estate and financial expert, Kim Kiyosaki, made a bold move in the mission to help Americans...

– Contributed Content, Northern Trust Corp. Sharing wealth too freely with your children or attaching “hard and...

By Taylor Ranker, founder and CEO of Questmont Remember the “circle of vultures” from the last article?...

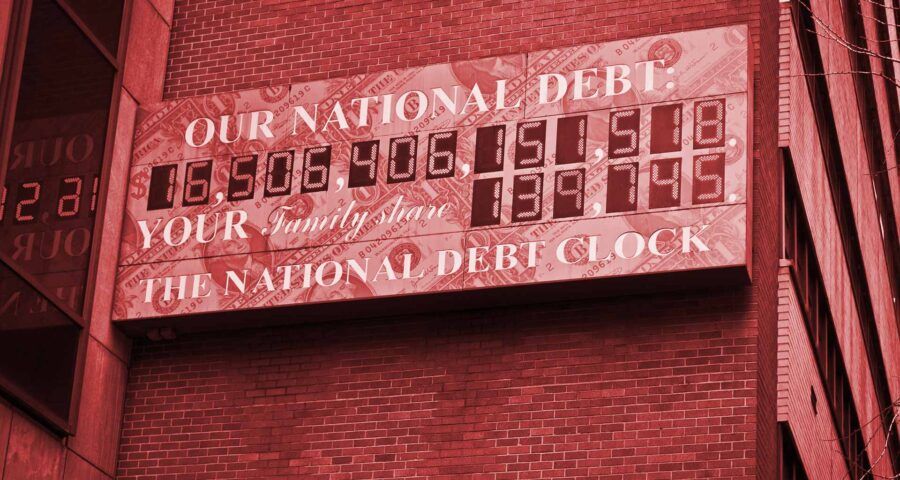

The U.S. national debt is rising by $1 trillion roughly every 100 days right now, which now...

Massive layoffs have been hitting the news at an increasing frequency, with Intel, CVS, Aetna, and John...