Florida is building its next financial center along a corridor of connected markets.

In Tampa Bay, banks are responding with hiring, new wealth teams and a sharper sense of what clients want.

Rory Glenn is stepping into that moment.

Regions recently named Glenn its private wealth management area leader for Tampa Bay. He said his mandate is clear.

“I’ve been tasked with more than doubling the size of the private wealth business in the greater Tampa market,” Glenn said.

Rory Glenn arrives as Tampa Bay accelerates

Glenn spent the last 18 years of his career in the Philadelphia market, working in wealth management and private banking at Citizens Bank.

His career taught him how to build teams, integrate strategy and scale a business without losing sight of the client.

He said he came to Tampa Bay for the timing.

“I really wanted to find an opportunity where I can make an impact in a community,” Glenn said.

READ: TAMPA BAY BUSINESS NEWS

Tampa Bay is still defining itself as private wealth, commercial expansion and migration converge at once.

“Florida is one of the fastest growing markets, not just in Florida, but the entire nation,” Glenn said.

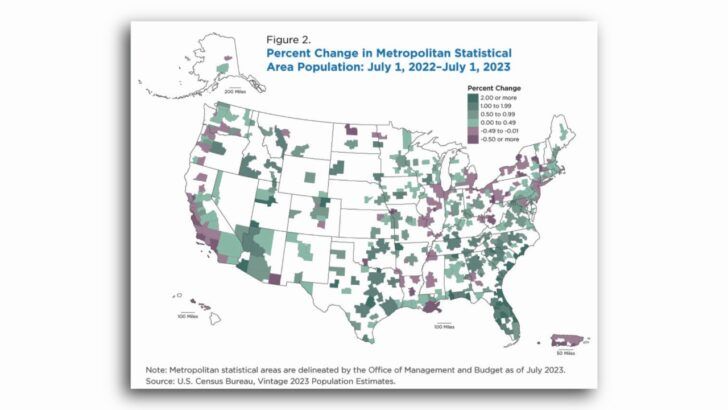

The Census Bureau’s latest metro latest metro estimates back him up. Florida claimed four of the nation’s fastest-growing metro areas from 2022 to 2023, and Tampa-St. Petersburg-Clearwater ranked among the top 10 for total population gains.

A financial center that behaves like a corridor

Americans have long mapped financial power to a single place: a skyline, a zip code or a dense cluster of firms and talent.

Florida is spreading wealth and finance across a connected corridor of markets, and Tampa Bay sits inside it. Glenn describes the region as a market that carries several Florida realities at once.

“Tampa is a microcosm of all of the markets that we see in Florida,” he said.

Where Regions is building in Tampa Bay

Glenn said Regions is expanding private wealth by placing teams where clients are concentrating.

“We’ve been doubling down on downtown,” Glenn said. “And we’ve been doubling down on the St. Petersburg market.”

READ: TAMPA BAY REAL ESTATE NEWS

He said the goal is depth, with enough advisors and subject matter expertise to meet client needs that are growing more complex.

Glenn said Regions is linking private wealth to its commercial bank presence in downtown Tampa, which brings business owners and executives into the same pipeline for wealth planning and investing.

The wealth mix that makes Tampa Bay legible

Glenn described Tampa Bay’s wealth base as steady and diverse.

“Business owners generally continue to generate, as well as retirees,” he said.

He described a pattern behind many new client relationships: owners sell businesses, take liquidity and relocate.

READ: TAMPA BAY RAYS NEWS

“Business owners who liquidate their businesses over time and relocate here into this part of the market,” Glenn said.

He also pointed to professional density as a driver, with Tampa Bay’s growing ecosystem helping wealth take root and scale.

“We also have a thriving professional network as well,” he said.

What clients want now

Ray Hand, Florida Wealth executive for Regions, said the tone of client conversations has sharpened over the past few years. Clients are bringing questions that demand interpretation and structure.

“Our clients are looking for help translating legislation into a personalized strategy,” Hand said.

READ: STATE OF TAMPA BAY’S ECONOMY

He said planning conversations are centered on long-range goals.

“We’re seeing more planning around portfolio and legacy goals,” Hand said.

Hand said policy shifts, market volatility and business cycles now force faster decisions.

Why hiring is the cleanest signal

Hand said Regions has set a clear staffing target for its Tampa Bay private wealth team.

“Over the next 18 to 24 months we’re looking to grow from six wealth advisors to 14,” Hand said.

Glenn said recruiting has worked because the pitch is grounded in culture and support.

“We’re building a culture-first team here,” Glenn said.

In private wealth, culture shapes how teams work together, how clients are served and how trust is earned over years.

Hand said Regions ranks Tampa Bay near the top of its internal opportunity map in Florida, which helps explain the urgency behind hiring and expansion.

What comes next

Glenn said Regions’ internal market data shows Tampa Bay still sits early in its growth cycle.

“Market data suggest that we will be able to more than double this business over the next two years,” Glenn said.

He said Regions is building for scale by assembling a full bench, with teams that can connect planning, lending and specialized expertise inside a single client relationship.

The corridor will reward firms that recruit talent, stay visible in the community and deliver advice that keeps pace with change.

Tampa Bay is drawing business exits, new residents and a deepening professional base, and Glenn came here to help build what comes next.

Stay Informed

Stay up to date on Tampa Bay business news, executive profiles and the companies shaping the region.