Business credit can be one of the biggest game changers for a company. It lets you invest...

Banking & Financial Advice

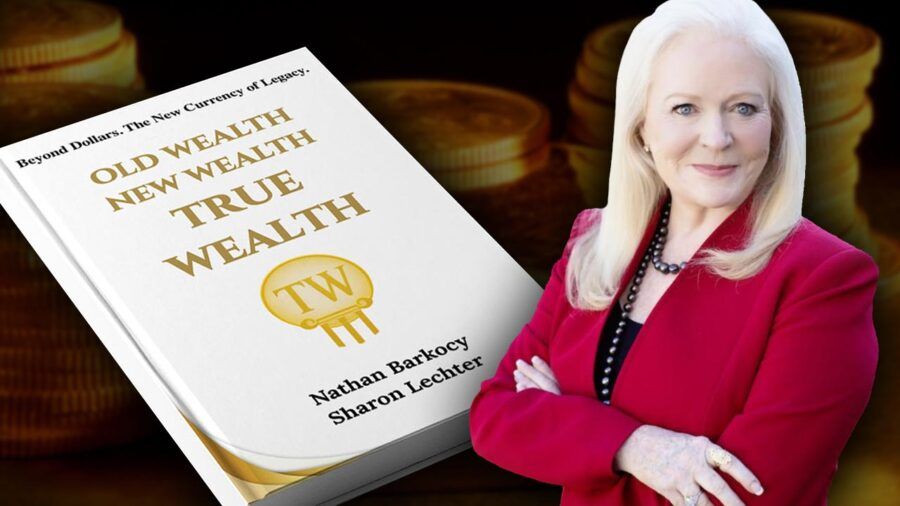

Lately, it seems that everyone is eager to share financial advice. Social media is full of people...

Regions is scaling private wealth in Tampa Bay as migration and deal flow accelerate.

A deeper look at financial illiteracy in America and how a lack of economic education shapes policy...

For years, medical professionals have followed the “safe” financial advice—build a practice, serve patients, and diligently contribute...

Recent data from Newsweek paints a troubling picture of retirement in America: Two in five retired Americans...

Let’s be honest—if you’ve been feeling whiplash from the stock market lately, you’re not alone. One minute...

In today’s dynamic real estate market, creative financing strategies have become essential tools for investors and homeowners...

Investor sentiment—not fundamentals—is what drives financial markets today. If you need evidence, just look at the past...

The April jobs report was just released, and on the surface, it looks like good news. Nonfarm...