What are the differences between nonprofit boards and for-profit boards? What do you do on a board? How do you get on a board? These were the questions discussed during the Tampa Bay Business & Wealth’s Women of Influence panel, held at Five Labs.

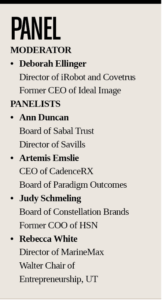

Deborah Ellinger, director of iRobot and Covetrus and former CEO of Ideal Image, moderated the panel which focused on women on corporate boards.

The transcript below has been edited or length and clarity. (See photos at the bottom of the story.)

Ellinger: We had a chance to chat with each other last night and we had an interesting conversation about whether or not being on a nonprofit board helps you to get onto a for-profit board. Rebecca, you had mentioned that you started out on nonprofit boards, and Judy, I think you didn’t, could you share some thoughts?

Ellinger: We had a chance to chat with each other last night and we had an interesting conversation about whether or not being on a nonprofit board helps you to get onto a for-profit board. Rebecca, you had mentioned that you started out on nonprofit boards, and Judy, I think you didn’t, could you share some thoughts?

Schmeling: I actually started directly with a Fortune 500 company, Constellation Brands. If you don’t know who Constellation is, you do because we own Modelo, Corona and wineries galore. I started off in finance and I was the CFO at HSN. This company was looking for, specifically, a woman CFO, that’s like finding your Elmo on Christmas Eve. There’s not many of us. I really didn’t go the nonprofit route. Being a CFO and working at HSN full time, I simply couldn’t have done a nonprofit board at that point in time. And even if I had though, it wouldn’t have mattered for me. The skillsets that they were looking for was for an audit committee chair. It was really what all my work experience was about.

Duncan: I think my path was a little bit different. Having been born and raised in Clearwater, we don’t have that many headquarters companies here and Fortune 500 or Fortune 100 companies. I started my own company and had a boutique firm. The civic route was a way to get engaged and to learn how to be on boards. I think sometimes that’s where you have to start if you’re here in Tampa Bay. I do believe if you’re going to do it, you better lead it.

Just being on the board doesn’t get you anywhere. You need to be the chair and you need to make things happen and have results. I think that does continue to help you be more successful in whatever you’re doing professionally. For me, it helped me grow my company, that got bought by a public company, and then I was able to also leverage that into getting on Sable Trust, which is the largest employee owned investment and trust company in Florida. At the end of the day, you got to have the right skillsets to be able to do the job they’re looking for to fill that niche.

Ellinger: You just mentioned skillsets, both of you, and I think it’s helpful to explain for the audience how boards actually go about finding other board members. Rebecca, you sit on a nominating and governance committee. Can you talk a little bit about that process?

White: It goes back to the previous question as well, because for me, I was fortunate to actually be the executive director of a nonprofit at one time. I had a board member who really taught me a lot about this and I was able to leverage it. He told me to behave like a CEO as opposed to a nonprofit executive director. One of the things that I learned from that was the whole concept of a matrix. And it’s very simple if you just think of a spreadsheet, what are the skills that are needed? And the name of the game that I see now is diversity.

Emslie: I was on an advisory board in an industry organization. It wasn’t exactly a nonprofit, but I was sitting around the table with other CEOs, which led to other conversations of saying that I’m interested in for-profit boards and putting my name out there with what my skill set was. The one thing that probably helped me was my overall business acumen because that’s what they were looking for.

I would also add that there’s a huge opportunity with all the private equity activity that’s going on. They are looking for diversity. They’re looking for people that are sitting right here in this room that have certain skill sets, as has been described here. To answer your question Deborah, I don’t know that my nonprofit experience was really that that got me there. It was more of the connections and putting my name out there and my experience.

Ellinger: You just raised something interesting, which is private equity backed boards as a way to get started. Rebecca, you have been on private equity boards. Can you describe a little bit what’s the same and what’s different about being on a private equity backed board versus a public board?

White: My experience is there was a lot more focus in a private equity board on immediate outcomes and a sense of urgency. That’s not to say public companies don’t have to perform, but shareholders were a lot closer in the private equity setting. Shareholder impatience was also an issue in the private equity companies. It felt to me a bit more intense in that regard.

Ellinger: I’ll add something to that. I’ve run private equity backed companies for 15 years and private equity board members are your investors and they are indeed looking for a return because they typically want to exit their investment in four to six years. They have phone calls with you every week. You are talking to them and doing formal presentations, probably every month and you are hiring people, you are firing people, you are making change happen as quickly as you can in your first year and then you’re building on that for the next four to six years. Contrast that with a public company board where you are meeting, let’s say five or six times per year. I think this would actually be a good thing to talk about as well is what does a public company board do?

Schmeling: I’m on three public company boards and they are all very, very different. Constellation Brands, which is a huge company and very well run, has meetings four to five times a year. I’m also on the nominating governance committee, so our board members were very diligent about reviewing that skill matrix and making sure that we’re having different types of diversity on the board. It’s a very standard process, if you will, for a public company board. One of our key criteria to be on that board is to understand the difference between what management’s responsibility and what is your responsibility as a board member. Because sometimes people don’t understand that.

On the Casey’s General Store board, it’s also a fortune 500 company, but the company’s not as sophisticated. We actually have calls more often and spend a little bit more time on different processes and procedures.

Then we have my little company in Canada [Canopy Growth Corporation]. We are not only small but we are creating an entire industry and we have calls all the time at a moment’s notice. In fact, I was sitting on my car having a call with someone, the head of our compensation committee, a few minutes ago.

White: My experience has been that timing is an issue because there’ll be a sense of urgency when you’re going through potential mergers and acquisitions, then things will calm down a little bit.

Ellinger: I’ve been on public boards for quite a long time and it varies a lot depending on what’s happening at that moment. We went through an activist fight, which was about six months of hell, and during that time I was lead director. I think I was on the phone every single day, figuring out communications and such. I honestly didn’t sign up for that. But that’s what you have to be ready for. If you’re going to be on a public board, you don’t know what’s going to hit. You’ve got to be involved and you don’t walk away from those things. You’re there because you’ve been asked to be helpful and to take them through it.

One of the things I think we want to talk about is the difference between a for-profit board and a nonprofit board. For those of you who are on nonprofit boards, do you want to talk about how different that is?

Duncan: I think there’s two different types. There’s your local civic organizations, where it’s pretty grassroots, and you start working on a committee then you work your way up. There’s also some pretty important appointed boards. I spent seven years overseeing the university system for the state of Florida, which had huge budgets. I chaired research and academic affairs and all the programming. I was probably spending 20 hours a week on that board to do it right. When I went off that board, my company doubled in revenue every year for three years. It comes with a price do it well and to do it right

At the end of the day, I’ve found the best way to really be involved and engage is you have to love what you’re doing and you have to be passionate about a cause, or you’re not going to really do it all that well.

Emslie: You have to roll your sleeves up on a nonprofit. It is time intensive and it’s more of an operator role where as you think about boards and the for-profit sector you, as Judy described, you have to separate yourself from being an operator to a board director and it is a very different role.

If I had to share my one experience of learning, going to a board and coming from being an operator, was how to sit back and just ask questions and not want to “do.” I mean you are a mentor and you are guiding but not the “doer” and you’ve got to respect what what’s on the other side of the table.

Ellinger: What was the biggest surprise as you got onto a board that was maybe different from what you thought about and that experience of now having to sit back and not do things?

Schmeling: I had a heightened awareness of the difference between a board position and management. I was really attuned to how management was feeling and I made sure that I talked to the management, either before or after a meeting. I would also ask for their feedback. How do you think I’m doing? Do you feel like I’m doing your job versus just my role?

Duncan: I think having been an entrepreneur and having run my own company where everything was in my control and purview, it was a little bit of a transition. I got to experience it on my government and my nonprofit boards first. That is something probably Sable Trust is very grateful for. It was a little hard, because you see something and you want to fix it but you really can’t. One of the things I try to do is be diligent and ask our CEO, “where is it that you think I can help you? Do you need me to roll up my sleeves and get involved or do you just want me to brainstorm with you?” Obviously if there’s something I have a real concern with, I speak up, but I really do kind of seek to their input on where to put my energy and talent.

Ellinger: I’m guessing that a number of you came here today because you’re interested in learning about how to get on to boards. I think one of the things we can see from this group is that these all were executive women who ran things at various companies and that’s what their journey was. To a large extent that is how it works, but I think it would be useful for a minute to go beyond the description of the matrix and the skills to how boards go about finding candidates. Talk a little bit about what do you think boards are looking for and how can people who are interested prepare themselves for it.

Emslie: If you’re looking at a for-profit fast-growth company, they’re looking at how you’re going to contribute to that equation, especially an outside director. Because you’re not a part of the equity team and you’re not with the organization. They’re looking for your experience on what you did to make your company successful. They’re looking for the broad experience of how they can expand and how they can grow. They have the foot on the gas and they’re going fast. As Deborah said, they’re looking to probably exit. So how can you help?

I would encourage you to create a bio that tells that story really quickly until you can answer that question. If you can give that elevator pitch really quickly, that’s helpful.

Schmeling: In terms of getting on board, there’s many different ways. I’d say the very first one is absolutely networking. Doing events like this, it might not seem like a lot, but this is how you meet someone, who meets someone, who meets someone. And that’s actually how I ended up on my very first board. It was this domino effect. It was someone else that referred the recruiter to me. I became really friendly with that recruiter and then he started calling me for all of these other different board positions. Do not underestimate the impact of that.

And sometimes you have to actively reach out to people yourself. There’s a lot of people who want to be on a board, so you have to contact as many people as you can.

White: I also joined the National Association of Corporate Directors. There are several different ways that you can connect. For me it was also about networking and knowing people. It might take three or four years, so it’s a process. You have to be diligent about it. You have to meet people that can help you. There are women on boards that would like to help you. ♦