INDUSTRIAL

Economy

As of February 2019, the unemployment rate in Hillsborough County fell by 30 basis points over the past 12 months to 3.3 percent. Nearly all industrial-related industries saw employment growth. Transportation, warehouses and utilities had the bulk of job gains, adding 1,600 jobs and a job growth rate of 5.3 percent. The region’s pace for new housing and commercial construction projects benefited the industrial market with many in- and new-to-market users taking space to meet consumer demand.

Market Overview

Overall absorption through the first quarter of 2019 totaled 52,146 square feet. Warehouse and distribution space leads the market with over 70,000 square feet of absorption—a significant improvement compared to the first quarter of 2018, when it shed approximately -60,000 square feet. Leasing activity ended the quarter with more than 362,000 square feet, a sharp decline after a historic 2018. The lack of construction completions in the first quarter limited leasing activity, a distinct contrast to the trends set last year. Warehouse and distribution made up the bulk of the leasing activity, accounting for 69 percent of the total leasing activity.

The overall vacancy rate slightly increased to 6 percent in the last 12 months, marking the 15th consecutive quarter the overall vacancy rate has remained below 7 percent. In contrast the direct vacancy rate dropped to 4.8 percent.

New construction continued to be a key driver within Hillsborough County’s industrial market. Central Florida Development completed a 137,500-square-foot speculative warehouse in Plant City across from Amazon’s 1 million-square-foot fulfillment center. The developer also has a 176,000-square-foot built-to-suit facility for Tredit Tire that is expected to open later this year. Hillsborough County was late to the game for new industrial development but experienced a resurgence in construction over the past two years with nearly 2.6 million square feet newly available. In addition, 2.8 million square feet were under construction at the end of the first quarter, the highest square footage under development at one time in Hillsborough County in more than 20 years. Unrelenting tenant demand bolstered further developer confidence in announcing additional phases and new industrial parks, mainly focused along the Interstate 4 corridor.

Industrial sales activity fell in the first quarter of 2019, with over 583,000 square feet sold. Sales activity continues to slow after a booming three-year period, 2014-17. The burst of sales, 2014-17, brought more than 16.1 million square feet traded. However, Cushman & Wakefield anticipates sales activity to increase some in 2019, as those assets bought before 2018 will have adequate occupancy and cash flow to incentivize sellers and investors alike.

Market Highlights

• New construction will provide additional space options to support further increases in leasing and sales activity.

• The industrial market continued to post positive market fundamentals through the start of the year.

OFFICE

Market Overview

Overall rents increased by 7.1 percent year-over-year to $26.59 a square foot. Class-A rents closed out the first quarter up 2.3 percent to $29.86 a square foot, bolstered by the Central Business District and Westshore submarkets, which saw increases of 6.5 percent to $32.49 a square foot and $33.59 a square foot, respectively. In fact, Class-A asking rent in Westshore rose to its highest level ever in the first quarter. Decreasing vacancies, as well as strong tenant demand, in the first quarter raised confidence by landlords across submarkets and asset classes to increase rents.

The overall vacancy rate for office space in Hillsborough County closed out the first three months of the year at 11.5 percent, a slight increase when compared to this time last year. The Central Business District submarket saw the most occupancy gains, ending the first quarter at 9.2 percent, a drop from first quarter 2018. In contrast, Westshore experienced a gain in vacancy from this time last year. This was in large part because of several blocks of more than 15,000 square feet of direct and sublease space hitting the market. Westshore’s vacancy rate is expected in increase later in 2019 because of Laser Spine Institute’s shutdown of all operations, including closing a 176,000-square-foot headquarters building located in the Westshore market. This will negatively influence the submarket’s vacancy rate in the second quarter.

Leasing activity remained strong through the first quarter and provided a strong pipeline of tenants taking space through the rest of the year. To date, nearly 470,000 square feet were leased, with suburban markets making up the bulk of the transactions, totaling approximately 291,000 square feet. The most prominent lease of the quarter was WeWork’s 60,000-square-foot lease in 501 E. Kennedy in Tampa. This location, along with the 50,000-square-foot lease in Heights Union, brought WeWork’s total footprint to over 110,000 square feet in the Tampa Bay area. Both locations are expected to open in early 2020.

2018 and early 2019 saw a flurry of new construction announcements, development updates, and pre-leasing activity. In late 2018, SoHo Capital’s Heights Union started construction on two 150,000-square-foot buildings in a mixed-used development, including the food and event hall Armature Works.

Advance-leasing activity has been robust with a 75,000-square-foot lease to Axogen in the first building and the aforementioned 50,000-square-foot lease by WeWork in the second building. The first building will be completed by year-end with the second building following in early 2020.

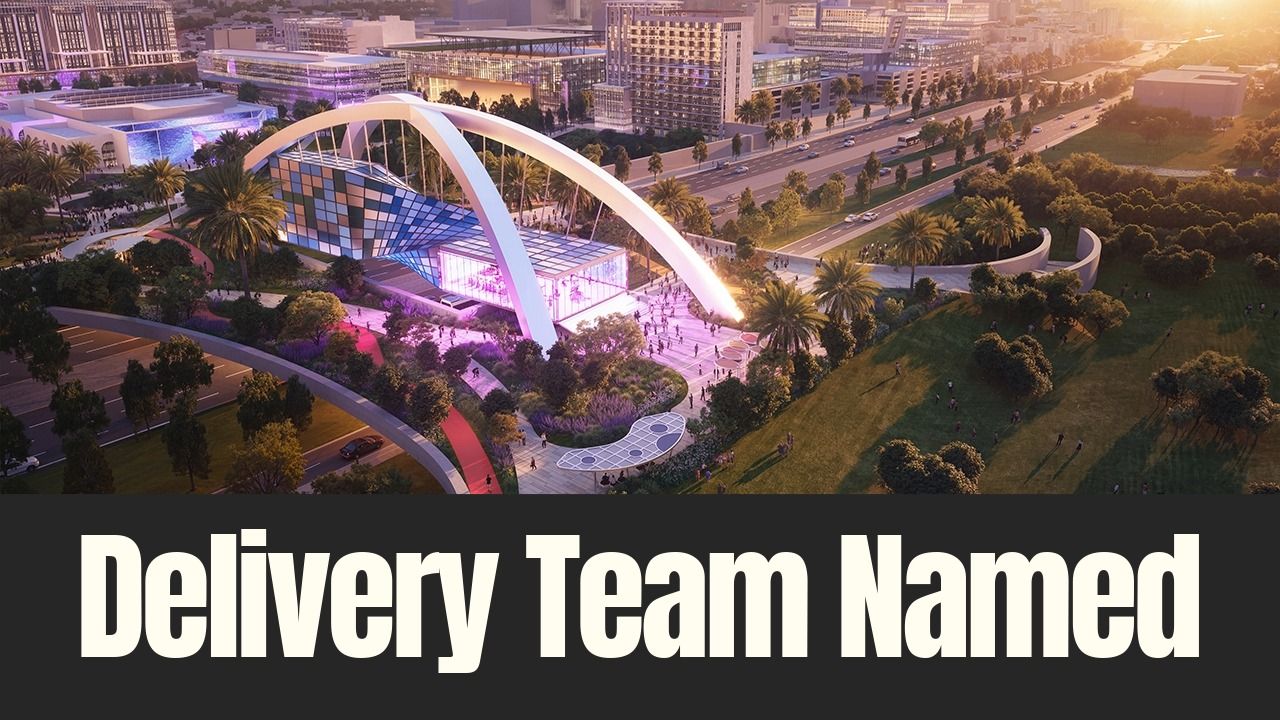

Strategic Property Partners’ Water Street, a multibillion-dollar mixed-use project backed by Tampa Bay Lightning owner Jeff Vinik and Microsoft founder Bill Gates, is moving forward with construction on the 180,000-square-foot office portion on Sparkman Wharf (See page XX.) The retail component with food vendors, open space and a biergarten opened in December 2018. MetWest Three also was under construction; the 250,000-square-foot building in Westshore was fully leased by PricewaterhouseCoopers.

The first quarter marked the most significant office construction in more than a decade with more than 730,000 square feet—the most office construction activity since the third quarter of 2008 when more than 890,000 square feet were under construction.

Another significant project on the horizon was MidTown Tampa, located in the Westshore district, near the intersection of Dale Mabry Highway and Interstate 275. The mixed-use project, developed by The Bromley Co., was slated to start substantial construction on the first phase in the second quarter of 2019. Phase One will make up the retail portion, including a Whole Foods, hotel, multifamily apartments, parking garage and a 160,000-square-foot speculative office building. This phase is slated to be completed before the 2021 Super Bowl, which will be held in Tampa.

Market Highlights

• The Hillsborough County office market posted strong market fundamentals through the first quarter of 2019.

• Rents are trending upwards, sustained leasing activity and positive absorption.

• Cushman & Wakefield anticipates rents to rise above current levels, with Class-A leading the charge.

Numbers for this report are based on first-quarter data. Source: Cushman & Wakefield.

Numbers are based on first-quarter data. Source: Cushman & Wakefield. ♦