Due to the widespread impacts of the Coronavirus (COVID-19) and small businesses’ need for emergency capital, the application process for the Florida Small Business Emergency Bridge Loan program has changed.

Effective immediately, eligible small businesses interested in applying for the Florida Small Business Emergency Bridge Loan program, a short-term loan designed to help business owners bridge the gap between the time of impact and when the business has secured long-term assistance, should apply for the program through one of two ways:

- Apply online and upload required supporting documentation or

- Download an application, complete it and mail it with the required supporting documentation to the Florida Department of Economic Opportunity (DEO) at: Florida Department of Economic Opportunity, C/O Small Business Emergency Bridge Loan, 107 E. Madison Street, MSC-160, Tallahassee FL 32399-4120.

Small businesses that have applied for the bridge loan program in response to COVID-19 should not submit an additional application.

More help for Florida has been requested by Gov. Ron DeSantis in a letter to President Donald Trump. DeSantis requested disaster unemployment assistance, crisis counseling, community disaster loans and the Disaster Supplemental Nutrition Program.

Last Tuesday, DeSantis activated the Florida Small Business Emergency Bridge Loan program. DEO administers the program in partnership with the Florida SBDC Network and Florida First Capital Finance Corporation. The state has allocated up to $50 million for the program.

“We have received an overwhelming response from businesses that have applied for assistance through the Emergency Bridge Loan program,” said the Florida Department of Economic Opportunity Executive Director Ken Lawson. “We are hopeful that businesses find this resource helpful in reducing the economic impacts from the state’s mitigation efforts in preventing the spread of COVID-19.”

Through the program, qualified small businesses with two to 100 employees impacted by COVID-19 can apply for interest-free loans of up to $50,000 for one-year terms. To be eligible, a business must be located in Florida, have been established prior to March 9, 2020, and demonstrate economic injury as a result of the virus.

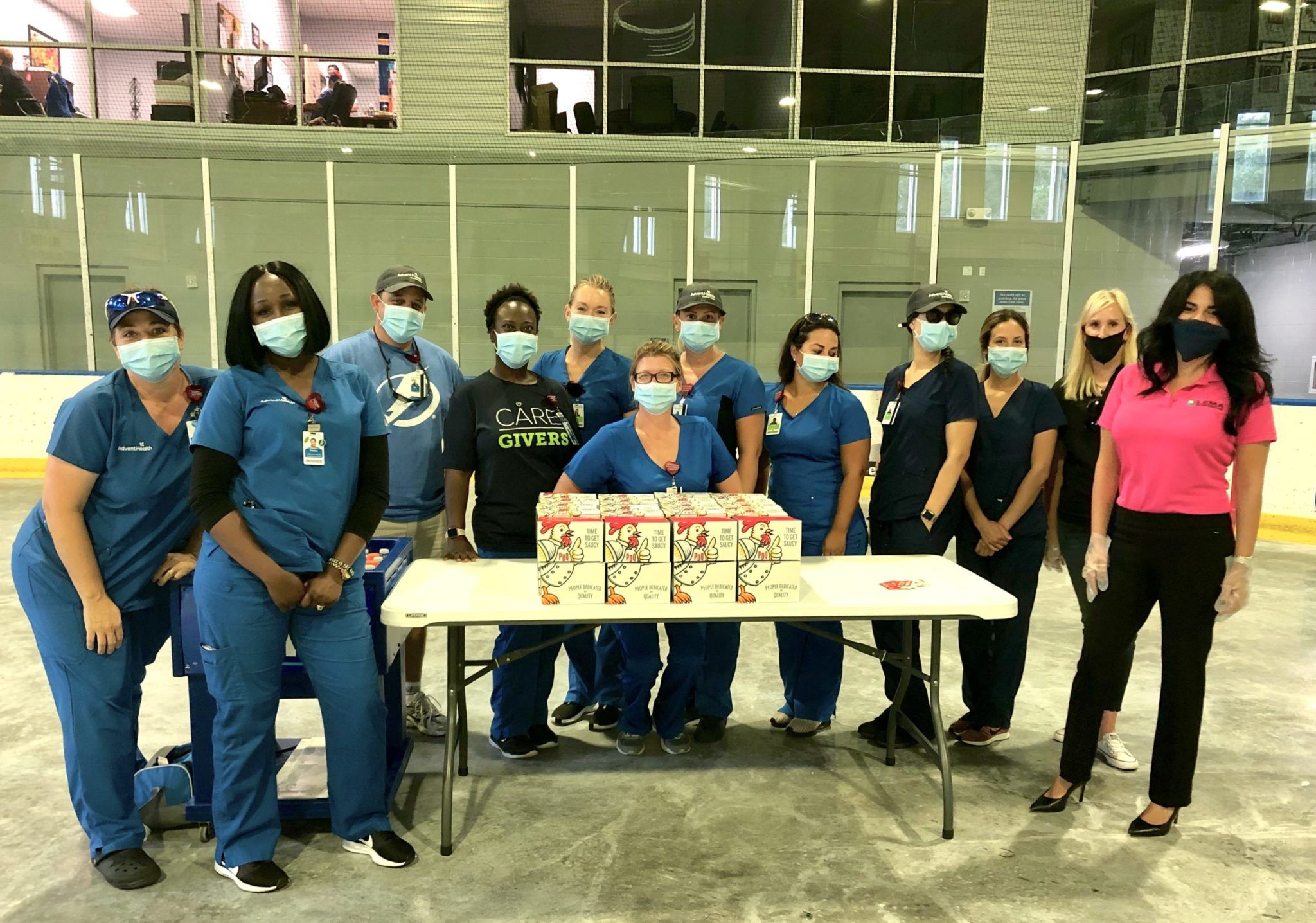

The Florida SBDC Network is a key economic development organization that supports disaster preparedness, recovery, and mitigation.

Florida SBDC business consultants, many of whom are Disaster Recovery Institute Certified Business Continuity Professionals, are available to assist small businesses through the loan application process and with other COVID-19-related challenges at no-cost.

“Small businesses are critical to our economy,” said Michael W. Myhre, CEO of the Florida SBDC Network. “We want business owners to know that we’re here to help and are committed to doing all we can to help them recover.”

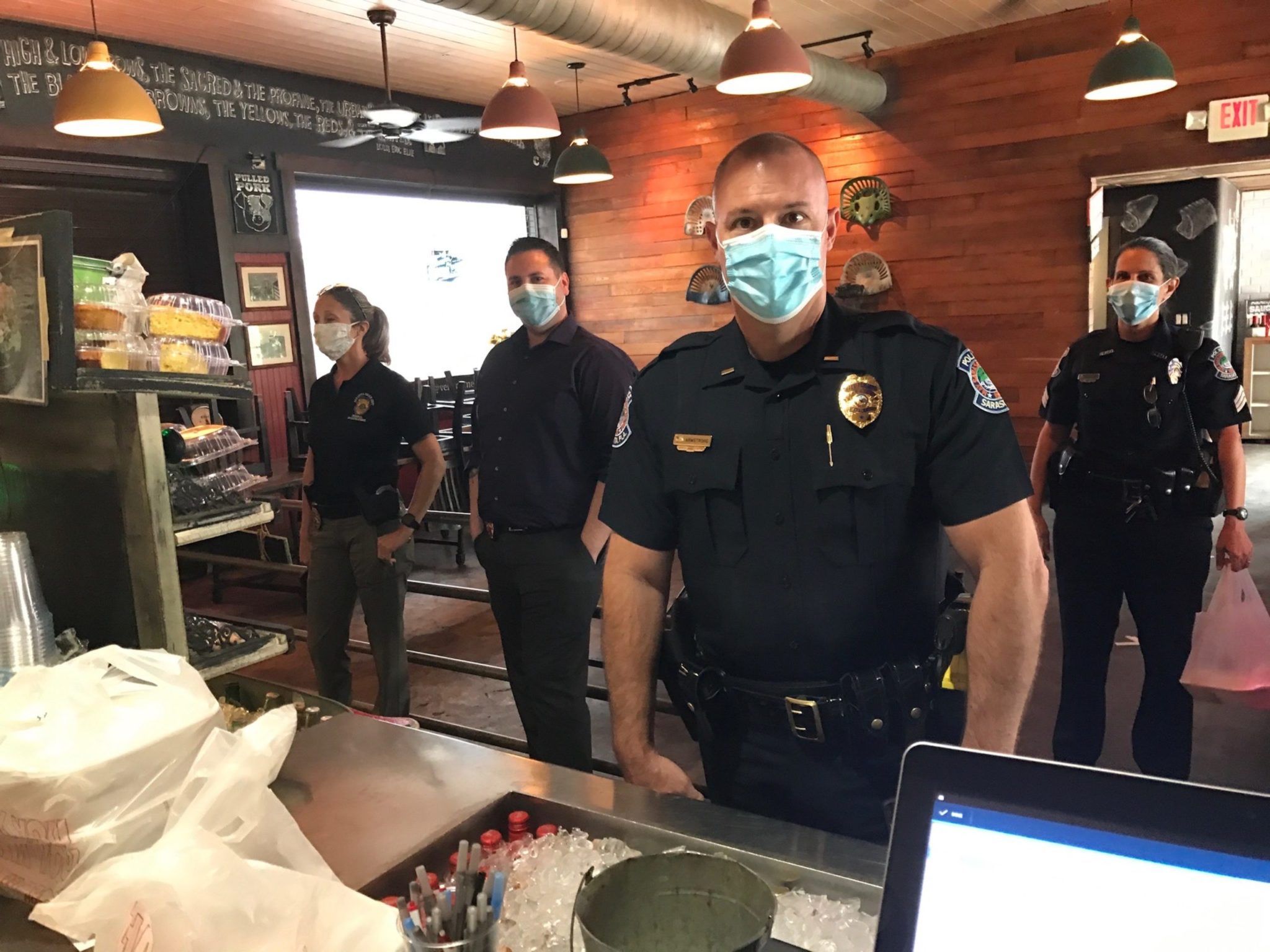

DEO is currently surveying businesses throughout the state of Florida who have been impacted by COVID-19. Businesses and non-profits can access the Business Damage Assessment survey at FloridaDisaster.BIZ. Select “COVID-19” from the drop-down menu on the survey page. Response to the Business Damage Assessment survey is not an application for assistance. Businesses interested in the bridge loan program must fill out a bridge loan application.

To complete a Florida Small Business Emergency Bridge loan application by the May 8, 2020 deadline, and for more information about the program, please visit www.FloridaSBDC.org.

For application assistance, Tampa Bay businesses can contact SBDC offices in the region here.

For questions regarding the loan program, please contact DEO toll-free at 833-832-4494 or email [email protected].